It's finally October! If you're a kid, that means you'll soon be drowning in more candy than you can possibly eat. And if you're a parent, that means you'll soon be scheming on how to get your hands on some of that extra candy.

Some parents require their kids to share the candy. Others leave it up to their children whether to share or not. And others simply avoid the topic and sneakily eat some when their kids aren't looking.

But now, there's another option: the candy tax. This is a brilliant way to teach your kids about finances while also scoring some sweet candy out of the deal.

Last year, the husband and wife who run the website Letterfolk shared a "Halloween Parent Candy Tax Form" on their blog. The printable form allows parents to set a certain tax rate for each of their kids, then divide the candy accordingly.

The form allows parents to decide which "tax bracket" their kids are in, set a tax rate, and then count up each type of candy (the "income").

"There are only two things that are certain on Halloween: candy and taxes," Joanna and Johnny, the couple behind Letterfolk, wrote about the tax form.

"Few teaching moments are better suited for helping your children learn about hard work, sweet rewards, and having said rewards taxed and consumed by their overlords. And it's only appropriate that you, their parent, should help them understand these valuable lessons."

"Depending on their tax bracket (or age), determine each child's suitable tax rate. After they have collected their sweet spoils and tallied up their various treats, multiply their income by their tax rate to compute their tax payment."

No more sneaking around for candy!

"We recommend that a parent be present during this process to ensure an accurate accounting, and to collect required tax payment immediately," the post continued.

Since last October, parents have been thrilled about the new idea. And they're putting it to use this year, too.

One parent even came up with a special bag just for the taxed candy.

And some parents already basically do this with all sweets, but without the tax form.

But you have to admit, filling out the whole form makes the whole "tax" idea a lot more legit!

Indeed, the form has already been put to good use. Here's what one mom earned with a very generous 3% tax rate.

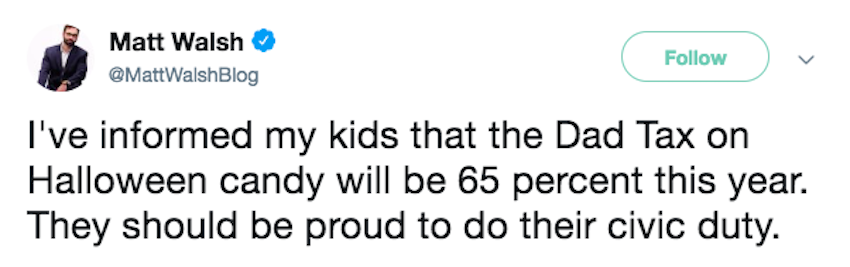

Others are taxing a LOT higher.

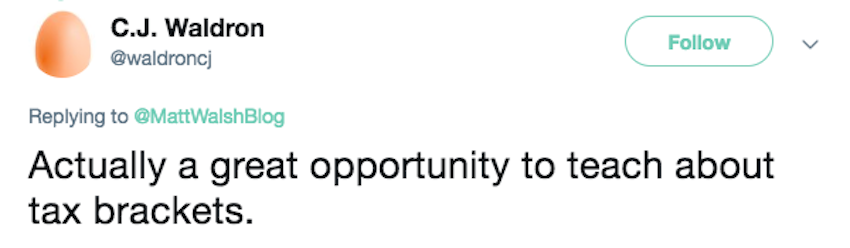

But on a serious note, the tax form is a great opportunity to teach your kids about how taxes work — something that many adults still don't understand.

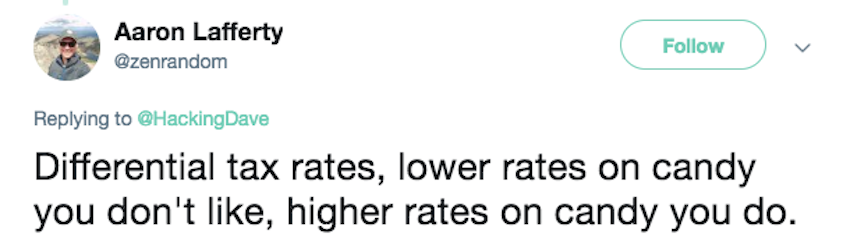

In addition to different income brackets, it might make sense to tax different types of candy at different rates — you know, to teach another lesson about value.

Some kids are more than happy to share the wealth, while others will probably be taken off-guard.

So definitely pick a percentage that will seem reasonable to your kids, and make sure to explain why taxes are so important.

Because eating your kids' candy on Halloween is one of the special perks of being a parent.

And you deserve those Reese's cups.