Using an ATM has become one of the most commonplace habits in pretty much every corner of the globe.

But how much do you really know about the machine providing you with cash? I know I never really gave them much thought — I'm usually just thankful to see I still have money in my bank account when I'm using the helpful device.

There's a surprising amount of information about their history and how to keep your funds safe while using an ATM. For example, do you know how long ago the first machine was put in place? Or what made other early models actually pretty dangerous for folks to use?

Take a look to learn more about the common device and how you can protect your cash from evil jerks trying to steal from you.

And don't forget to SHARE all the information with your friends on Facebook!

Thumbnail Photos: Flickr / Tomek Augustyn // Wikimedia Commons

1. There Could Be Way More Hidden Fees Than You Think

According to reports from AARP, there are several fees that most of us don't realize are included with various transactions.

Most of us know we can be charged extra for using a machine not owned by our personal bank, but other fees include: a charge for mailing a monthly paper statement of your ATM activity, another for using the machine "excessively," and even a fee for a transaction being denied due to insufficient funds.

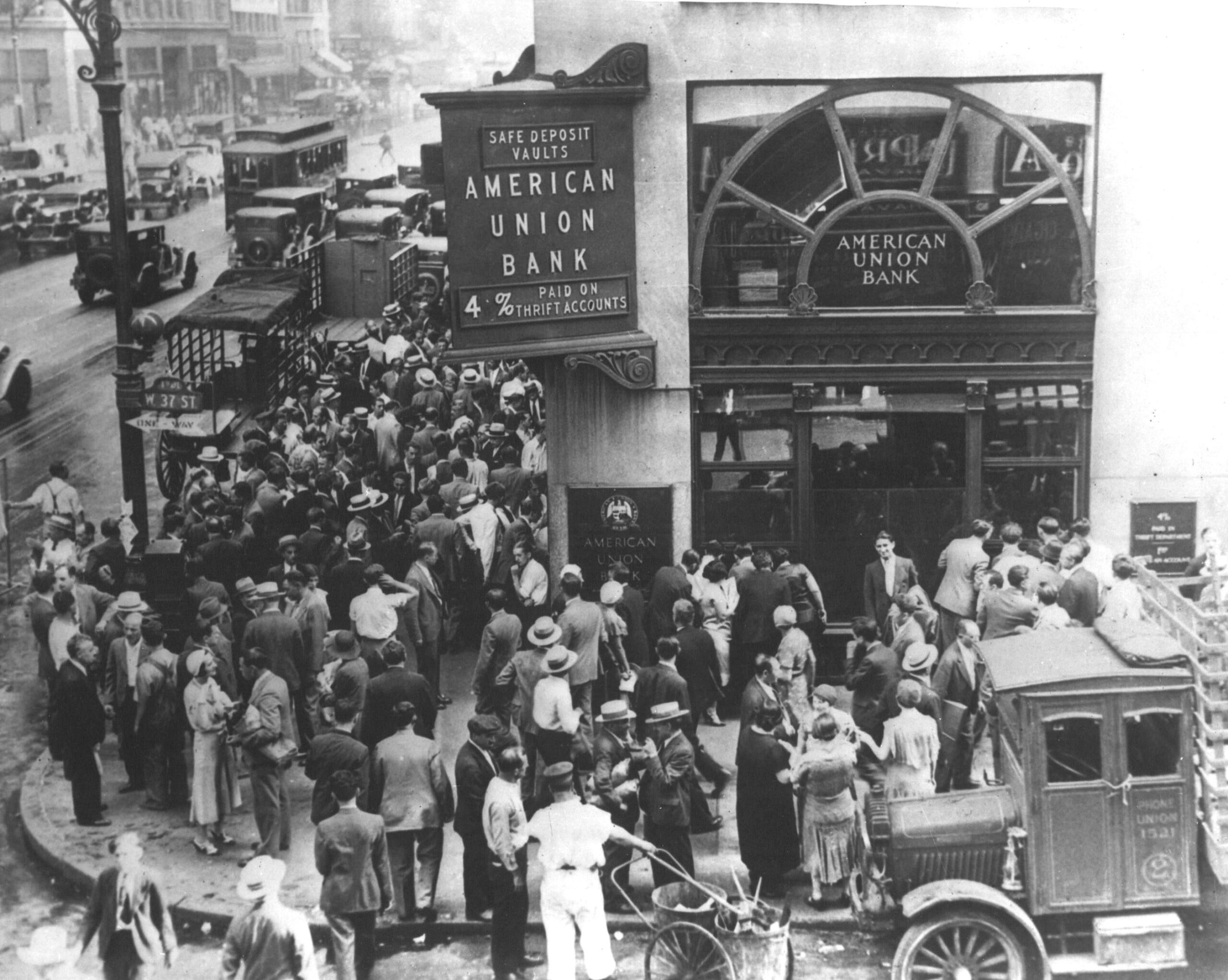

2. They've Been Around Since The 1930s

In 1939, a man named Luther Simjian submitted the patent for the first ever ATM.

He called it the "Bankmatic" and it was installed at City Bank of New York, but it wasn't a big hit. The bank got rid of it after just six months.

3. The Machines Used To Be Radioactive

British inventor John Shepherd-Barron is credited with crafting the predecessor of our current machines, but there was one slight catch: Users were exposed to a wee bit of radiation.

Since there were no debit cards yet, folks used a check lined with carbon 14, which the machine would recognize and match with their PIN.

4. Thieves Can Easily Steal Your Info

Criminals have been attempting to exploit ATM users since they first became popular in the 1960s.

Early antics started with fake machines and have since escalated to high-tech devices, known as "skimmers," recording your personal information. PCMag recommends checking each machine before you insert your card by looking for tampering and giving the sections a good wiggle.

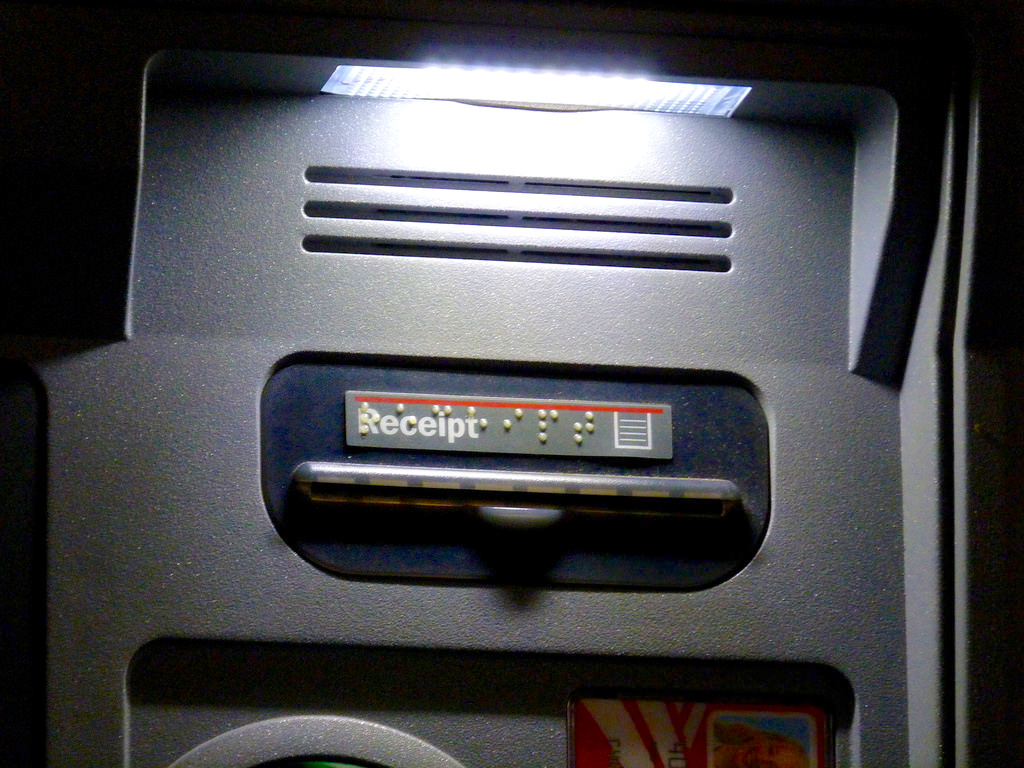

5. Drive-Thru Machines Still Have Braille

This might sound a bit odd considering most visually impaired people don't find themselves behind the wheel of a car.

But the Americans with Disabilities Act made the markings a requirement for all machines. This has likely been helpful in cases where someone is riding as a passenger and doesn't want to reveal their PIN to the driver.

6. Using Cash Back At Stores Might Be Smarter

Grabbing extra cash at a convenience store not only helps to make sure your information stays safe from thieves, but can help with avoiding those pesky hidden fees.

7. Friday Is A Popular Day For Using Them

It's probably not all that surprising to learn that many of us all across the globe hit up our local cash machines before heading out to have fun on a Friday or stock up on dough to last the whole weekend.

8. America Has More ATMs Than Any Other Country

Although we have the most when it comes to the sheer number of machines — over 420,000 according to the Washington Post — other countries like Brazil and Russia outrank us when it comes to the number available per 100,000 users.

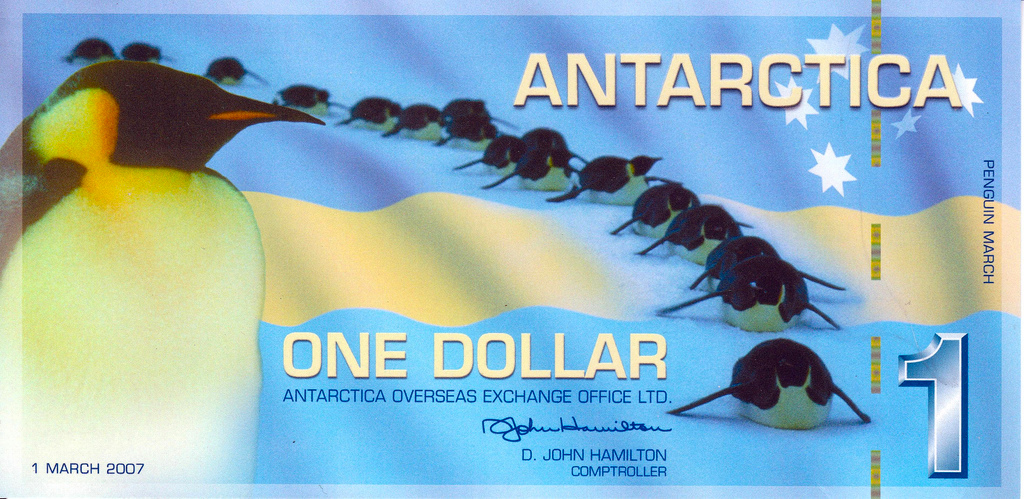

9. There Are Even Machines In Antarctica

According to blogger Jason Kottke, there are two very lonely machines at the solitary ATM station on the planet's southernmost continent, operated by Wells Fargo.

10. The Average Withdrawal Is $60

We don't generally want to carry around a ton of cash and make ourselves extra vulnerable to loss or theft.

This sum is a nice middle ground between modest and excessive amounts.

11. You Might Not Need A Card Soon

Technology continues to evolve for these machines, with new functions becoming more available over the years. The trend toward biometric identification will likely make using a card to access your funds a quaint thing of the past sooner than we think.

Were you surprised by any of these ATM facts?

Be sure to SHARE all the information with your friends on Facebook!