As tax season rolls in, people across the country are getting stressed out about their finances.

Filing taxes is no fun for anyone, but it's something we all have to do. While many people turn to accountants for help, others do their own taxes.

One thing that makes tax season more stressful is the threat of the Internal Revenue Service (IRS). People think that if the IRS gets involved with their taxes, they'll be audited or lose more of their wages/income.

In reality, the IRS is not something most people need to worry about. According to Lisa Greene-Lewis, a tax expert for TurboTax, "The audit rate is still under 1 percent for those who earn about $200,000 (annually)."

Many people even get tax returns after filing their taxes — sometimes they even receive large amounts of money, like a woman who received $5,400.

That means that the IRS should not be a concern for many Americans. So, if it's not an issue most people will face, why are so many concerned about the threat of the IRS?

It's because of scam artists around the country who pose as IRS agents in order to take money from unsuspecting Americans. Here's how to avoid getting scammed this tax season.

If you get a phone call from the IRS this tax season, you should hang up the phone immediately.

This might seem counterintuitive, but the fact is that you're probably talking to a scammer, not the IRS.

According to the IRS website, "The IRS will not call you to demand immediate payment. The IRS will not call if you owe taxes without first sending you a bill in the mail."

If you haven't received a bill in the mail from the IRS but you're getting a call, it's definitely a scammer.

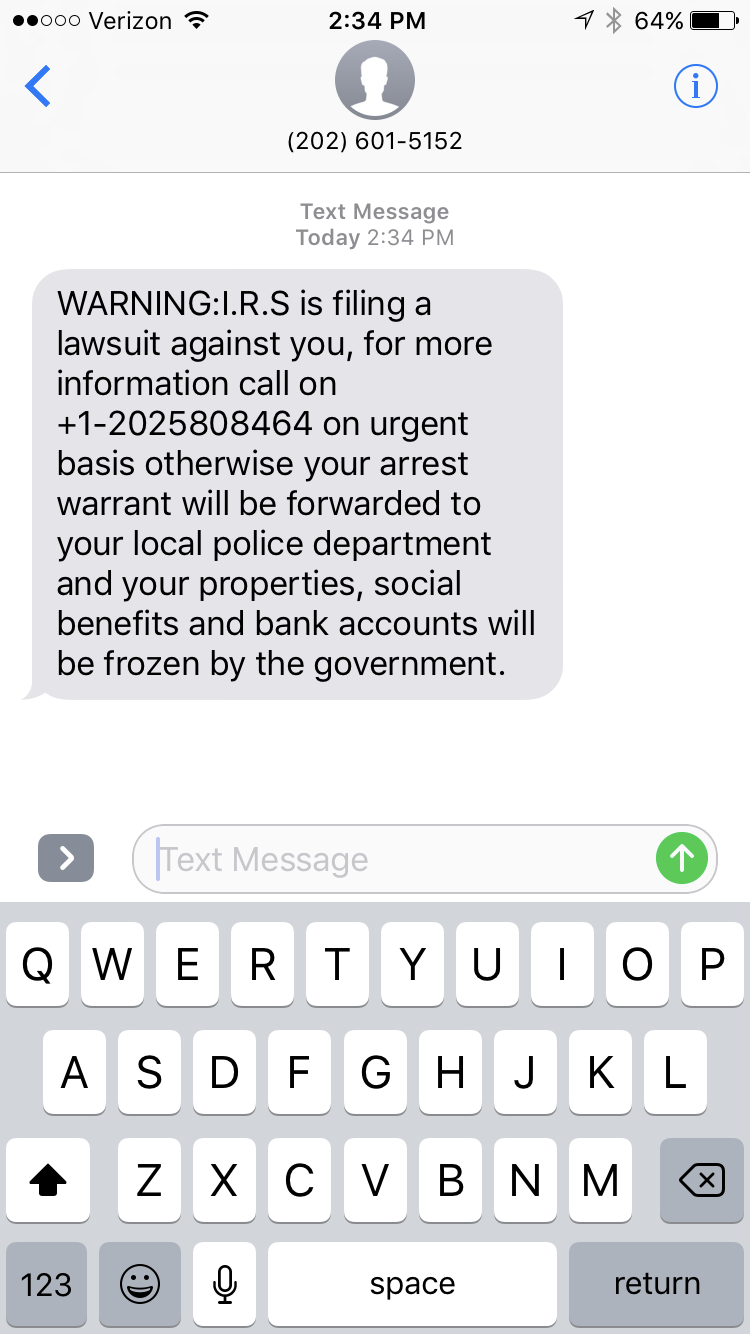

The same goes for text messages. If you receive a text claiming they're from the IRS, it's a scam.

According to the IRS, there are other things to look out for when dealing with possible scams. The IRS website explains:

Scammers make unsolicited calls.

Thieves call taxpayers claiming to be IRS officials. They demand that the victim pay a bogus tax bill.

They con the victim into sending cash, usually through a prepaid debit card or wire transfer.

They may also leave “urgent” callback requests through phone “robo-calls,” or via phishing email.

Callers try to scare their victims.

Many phone scams use threats to intimidate and bully a victim into paying.

They may even threaten to arrest, deport or revoke the license of their victim if they don’t get the money.

Scams use caller ID spoofing.

Scammers often alter caller ID to make it look like the IRS or another agency is calling.

The callers use IRS titles and fake badge numbers to appear legitimate.

They may use the victim’s name, address and other personal information to make the call sound official.

Cons try new tricks all the time.

Some schemes provide an actual IRS address where they tell the victim to mail a receipt for the payment they make.

Others use emails that contain a fake IRS document with a phone number or an email address for a reply.

These scams often use official IRS letterhead in emails or regular mail that they send to their victims.

They try these ploys to make the ruse look official.

So what should you do if you get one of these calls, texts, or emails?

If you do not owe taxes, hang up the phone. Do not respond to texts or emails, and definitely do not give out any of your information.

If you think you do owe taxes, call the IRS directly. Employees there can help you figure out whether or not you owe taxes, and they will help you pay if you do.

The IRS phone number is 1-800-829-1040.

Phone scams are very serious, so everyone should be aware of them.

To save your friends and family from these scary scams, please SHARE this information on Facebook.