Money: as much as we'd all like to deny it, it is a crucial part of living a comfortable life. We don't need piles of it, but we need to know how to manage what we have.

If we're lucky, we could fall into savings like this little baby. If we're like most people though, we're going to have to take care of things on our own.

I know that keeping track of money is a huge problem for me. It all seems incredibly overwhelming, so I tend to just not look at my account and hope for the best when it comes time to paying rent money. Sometimes, not-so-surprisingly, that doesn't always work out too well — imagine that!

These 11 mistakes are some of the biggest ones that Americans make with their money all the time. I know I'm guilty of just about every single one of these, but fortunately, it does actually seem fairly simple to make the changes I need.

Will you make any changes after reading this list? Did we forget any other extremely common mistakes? A little bit of savings can go a very long way, and fixing these problems is bound to add up.

Please SHARE this important money saving information with your family and friends on Facebook.

Thumbnail source: Flickr

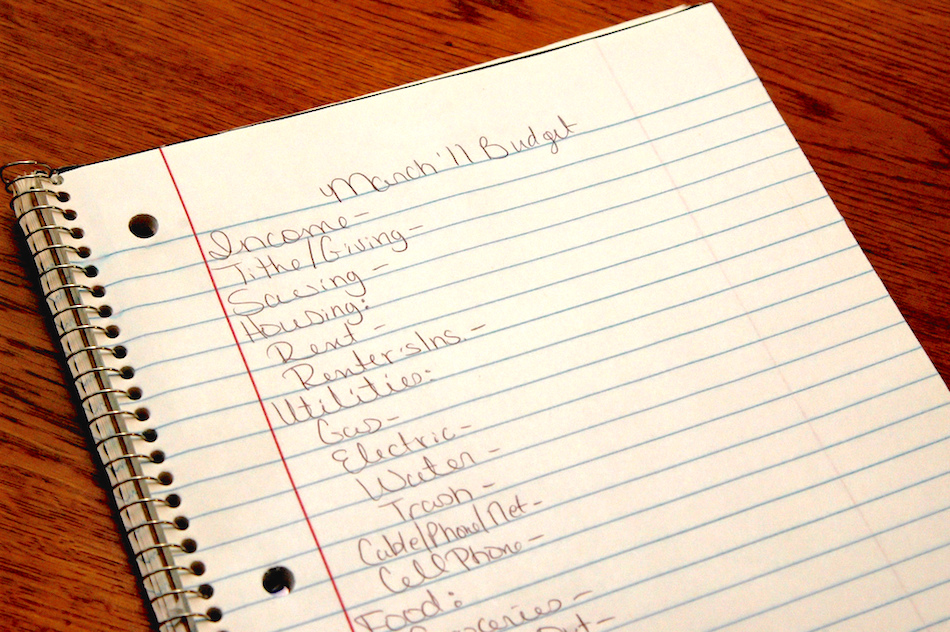

1. Not Keeping A Monthly Budget

All this means is that you're setting goals. Think about what you want to do with your money in the future, and create a plan to make sure you have enough by the time you reach each expense. It will help you spend more consciously and make good money decisions all around.

2. Assuming Everything Will Stay In Tip-Top Shape

Things break, and that's just a fact of life. Important things that we all depend on crap out on us all the time, like our cars, roofs, washing machines, and even health. You always need to make sure you have some type of “rainy day” savings to cover these unexpected, yet inevitable, expenses.

3. Eating Out Too Much

Yes, everyone needs to eat. But when you calculate how much money you save by buying groceries instead of ordering in to the office for lunch four days a week, you might shed a tear. That lunch money can buy you a vacation. Seriously — do the math!

4. Cutting Important Corners

Instead of always going for the bargain, pick and choose where your big bucks should go. You don't want to rush into buying the hunk of metal someone used to call a car that you saw on the side of the street for $900: you're going to end up spending many more times that amount down the road on repairs.

5. Buying An Unaffordable Home

A house is a huge purchase, and while other things like a car might be able to push budget boundaries, it's a bad idea to do that with a home. Financial experts say you don't want to spend a penny more than 34 percent of your monthly income on a mortgage.

6. Forgetting About Retirement

In addition to perpetual savings and a savings account for repairs, retirement savings are crucial. If you're young, save for retirement. If you're already near retirement… still save for retirement! Late is better than never.

7. Not Understanding Terms

APR, interest, hidden fees, balance transfers: these are all terms you need to fully understand before heading to the bank. You can lose a lot of money if you don't know what you're getting yourself into with a new credit card or loan.

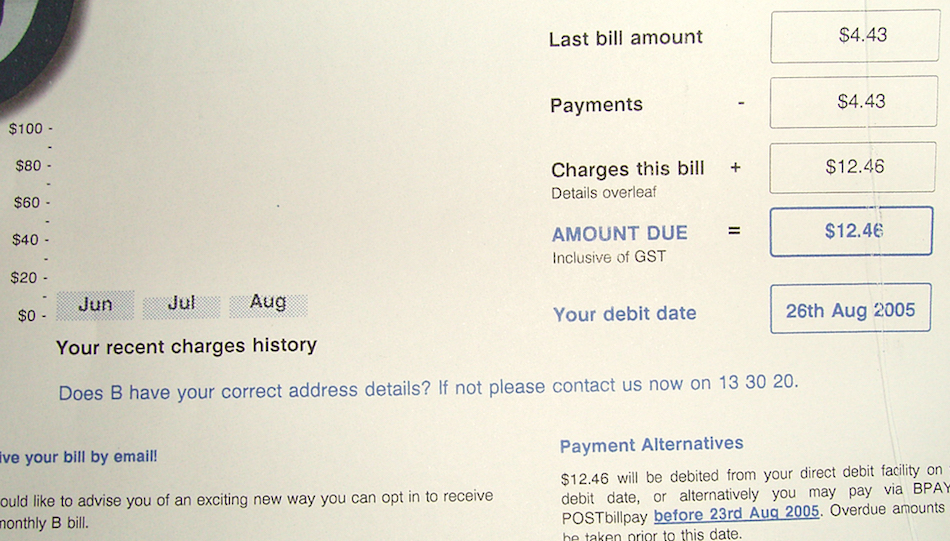

8. Accumulating Tons Of Monthly Payments

Installments seem like a great idea, but if you have too many of them, they can really add up. Take some time to consider which of these monthly expenses you really need. How often do you really use your cable now that you can get so much online? Do you really need the fancy gym membership when there's one for half the cost? These are the questions that could really cut the fat out of your monthly spending.

9. Putting Every Egg Into The Same Basket

Investing is great, as long as you do it the smart way. You never want to put all of your money into one single stock, because if that stock doesn't do well, all your money is gone. Diversify your investments between stocks, bonds, money market funds, and other areas.

10. Using Credit Cards For Everything

Using your credit card for things like gasoline and groceries might seem like a good idea at the time, but when you think about it, you're actually paying huge interest rates on these things months later, once you've already refilled your car dozens of times, and that fancy box of crackers is long gone. Either pay off your balance each month, or try to use the money you have before you borrow from credit.

11. Dumping Money Into Careless Spending

This one seems obvious, but each and every one of us does it. Dropping a bunch of cash on something you truly do not need while you already have mounting credit card debt is a habit that needs to be broken.

Do you make any of these mistakes? What else did we forget from our list? Let us know in the comments and please SHARE with family and friends on Facebook to help them save their money, too.